Introduction to SOXL: What You Need to Know

The SOXL stock, or the Direxion Daily Semiconductor Bull 3X Shares, is a leveraged exchange-traded fund (ETF) tailored to magnify the daily performance of the semiconductor sector. As a financial instrument, SOXL is designed to provide investors with three times the returns of the Philadelphia Semiconductor Index (SOX), making it an attractive option for those who wish to capitalize on the dynamic movement of semiconductor stocks. The inception of SOXL marked a significant development in the investment landscape, offering a unique way to gain exposure to high-growth technology companies within the semiconductor realm.

Leveraged ETFs, such as SOXL, operate by using financial derivatives and debt to amplify the returns of underlying indices. This means that while SOXL can offer substantial gains during bullish market phases, it also comes with increased risks during downturns. The amplified nature of this ETF can appeal to traders seeking short-term gains rather than long-term investment strategies, given the potential volatility associated with leveraging. It is crucial for investors to comprehend both the opportunities and risks involved in trading SOXL, especially in a sector that is inherently subject to rapid changes in technological advancements and market trends.

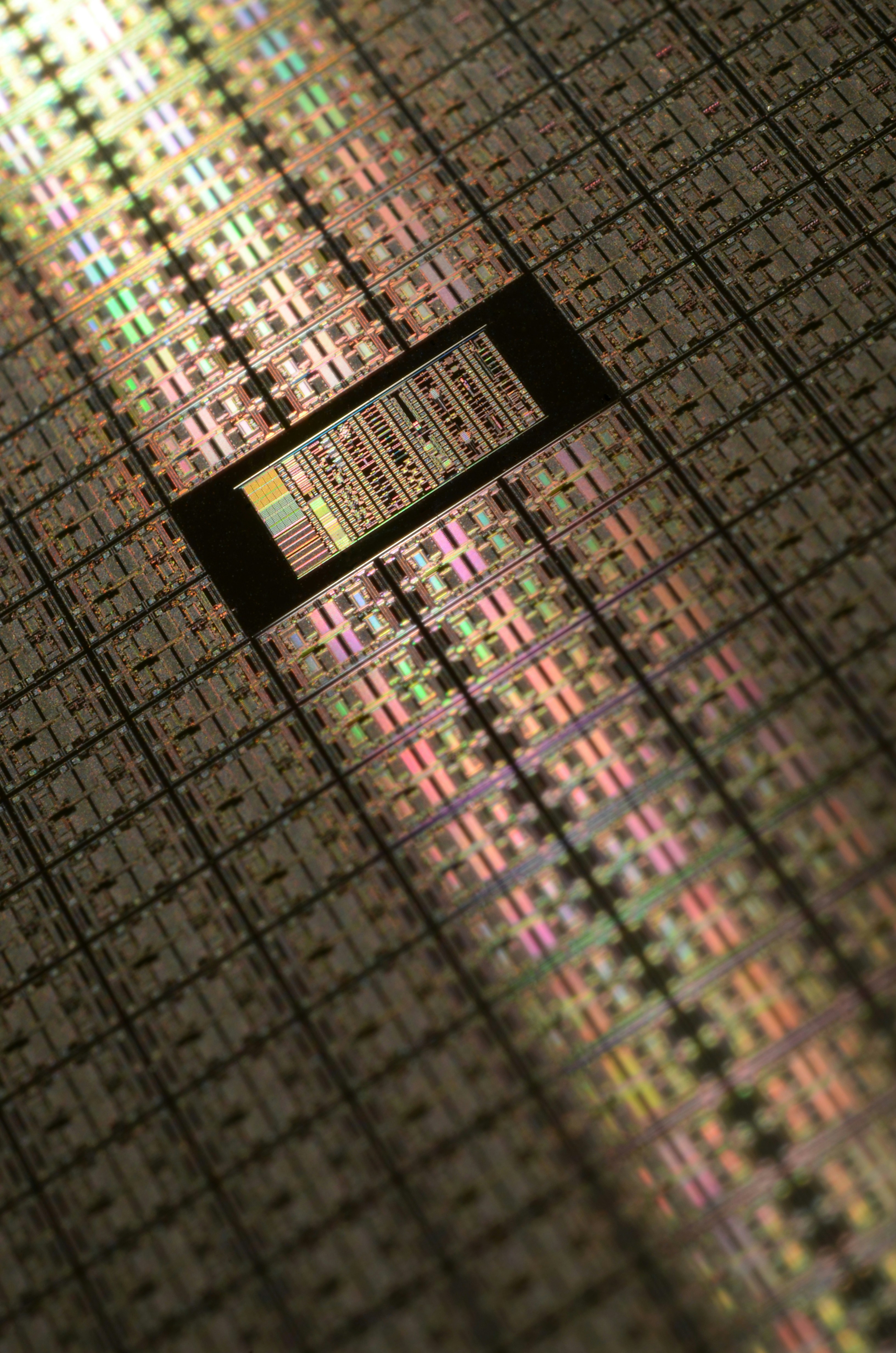

The semiconductor sector holds a vital position in the global economy, serving as the backbone for various industries, including consumer electronics, telecommunications, automotive, and cloud computing. As technology companies continue to expand their operations and develop innovative solutions, semiconductor stocks often witness substantial price movements, making them particularly appealing to investors seeking high-growth opportunities. Overall, understanding the dynamics of SOXL is essential for individuals looking to navigate the complexities of the semiconductor market while harnessing its growth potential.

Recent Trends in SOXL Stock Price

In analyzing the recent trends in SOXL stock price, it becomes evident that this stock has experienced notable fluctuations over the past several months leading up to October 2023. SOXL, an exchange-traded fund that aims to provide investment results corresponding to the performance of the PHLX Semiconductor Sector Index, has demonstrated significant sensitivity to market conditions. The semiconductor sector has been notably volatile due to various factors, including investor sentiment, supply chain challenges, and advancements in technology.

Throughout the year, SOXL’s price movements have closely mirrored events such as changes in interest rates and global supply chain disruptions that have impacted the semiconductor industry. For instance, fluctuations in demand for semiconductor products, influenced by upstream supply issues and geopolitical tensions, have often resulted in corresponding shifts in SOXL’s stock price. Additionally, notable technological advancements in semiconductor manufacturing have spurred investor optimism, contributing to upward price trends in several months.

Moreover, data shows that SOXL experienced a surge in stock price during periods when major tech companies reported strong quarterly earnings, reflecting a broader market trend and investor confidence in the semiconductor sector. The initial months of 2023 saw SOXL reflect an upward trajectory, reaching price levels that were previously seen before market disruptions. However, this rapid growth was met with periodic corrections, emphasizing the stock’s volatility.

Comparing SOXL’s performance to its historical data further reveals cycles of stability and turbulence, particularly influenced by broader economic indicators such as inflation rates and consumer spending trends. Monitoring these elements has proven essential for predicting potential price movements in SOXL. Given the current trends, understanding these dynamics is crucial for potential investors or stakeholders looking to navigate the semiconductor investment landscape effectively.

Factors Influencing SOXL Stock Price

The stock price of SOXL, a leveraged exchange-traded fund (ETF) that targets the semiconductor sector, is influenced by a multitude of economic, geopolitical, and sector-specific factors. Among these, interest rates play a critical role in shaping investor sentiment and market dynamics. Rising interest rates often lead to increased borrowing costs, which can dampen economic growth and negatively impact semiconductor demand, ultimately affecting SOXL’s stock price. Conversely, a decrease in rates may stimulate investment and spending, providing an opportunity for growth in the semiconductor industry.

Inflation also significantly impacts the SOXL stock price. High inflation can erode consumer purchasing power, leading to reduced demand for electronic devices that rely on semiconductors. Additionally, persistent inflation may prompt central banks to adopt tighter monetary policies, potentially squeezing the profits of semiconductor companies and influencing investor confidence in the ETF. Therefore, monitoring inflation rates and adjustments in central bank policies is essential for understanding potential fluctuations in SOXL’s value.

Geopolitical factors such as trade policies further complicate the landscape for semiconductor stocks. Tariffs or restrictions imposed by governments can directly impact the supply chain of semiconductor firms and affect their profitability. For example, current trade tensions between the U.S. and other nations could hinder the ability of companies within the semiconductor industry to operate efficiently, thereby influencing SOXL’s performance.

Moreover, sector-specific competition among semiconductor firms shapes SOXL’s stock price dynamics. As technology advances, newer, more efficient products disrupt the market, potentially altering the competitive landscape. Investors should pay close attention to developments in the semiconductor sector, as shifts in competition can have substantial effects on the valuation of SOXL.

In conclusion, a holistic understanding of these various factors enables investors to better navigate the complexities affecting SOXL’s stock price and to develop informed strategies regarding their investments.

Future Outlook for SOXL Stock Price

The future outlook for the SOXL stock price appears to be closely tied to the broader trends within the semiconductor sector, which continues to experience substantial growth driven by increasing demand across various industries. Key factors that may influence SOXL’s value include technological advancements, regulatory changes, and macroeconomic conditions. Analysts speculate that the ongoing evolution in artificial intelligence, data processing, and cloud computing will bolster semiconductor demand, benefiting SOXL as a leveraged ETF that targets semiconductor stocks.

Expectations are high for the semiconductor market, with experts forecasting continued expansion fueled by innovations in 5G technology, Internet of Things (IoT) devices, and automation technologies. Additionally, the global push for greener energy solutions has led to an increased focus on semiconductors used in electric vehicles and renewable energy implementations. These trends should positively affect SOXL’s price trajectory, provided that semiconductor manufacturers can address supply chain challenges and maintain production efficiency.

However, prospective investors should remain cognizant of potential risks associated with investing in leveraged ETFs like SOXL. Market volatility, regulatory changes, and adverse economic indicators can significantly affect performance. For instance, if inflation rates rise or economic conditions worsen, the semiconductor industry may face reduced investment, leading to price fluctuations in SOXL. Investors must balance these risks against the inherent rewards of engaging with a rapidly evolving market.

Given these insights, those considering SOXL as part of their investment portfolio should closely monitor semiconductor market trends, technological advancements, and regulatory developments. Fostering a cautious yet proactive investment strategy can help investors maximize opportunities while mitigating potential downsides in this dynamic sector, thus positioning them for success with SOXL stock. In conclusion, a broad understanding of market dynamics and potential future developments will ultimately guide investment decisions regarding SOXL.