Introduction to Intel and Its Market Position

Founded in 1968, Intel Corporation has become a cornerstone of the semiconductor industry, renowned for its innovations and extensive range of products. Initially recognized for its microprocessor manufacturing, Intel has expanded its portfolio to include various technologies such as chips for data centers, Internet of Things (IoT) devices, and artificial intelligence (AI) solutions. This diversification underscores Intel’s commitment to meeting the evolving demands of modern computing and technology.

Intel’s microprocessors have long been pivotal in powering personal computers and servers, capturing a significant share of the global microprocessor market. However, its market position has faced challenges in recent years, particularly against rivals like Advanced Micro Devices (AMD) and NVIDIA. These competitors have gained traction, particularly in high-performance computing and graphics processing, thereby forcing Intel to adopt more aggressive strategies to reclaim its prominence. As a result, Intel has emphasized innovation and expansion in fields such as AI and machine learning, while also investing in advanced manufacturing technologies.

Financially, Intel has shown resilience despite facing headwinds, including supply chain disruptions and increased competition. Its latest quarterly earnings revealed robust revenue streams, with strategic investments anticipated to enhance production capabilities. However, the ongoing competition with AMD and NVIDIA has pressured Intel to refine its product offerings and pricing strategies further.

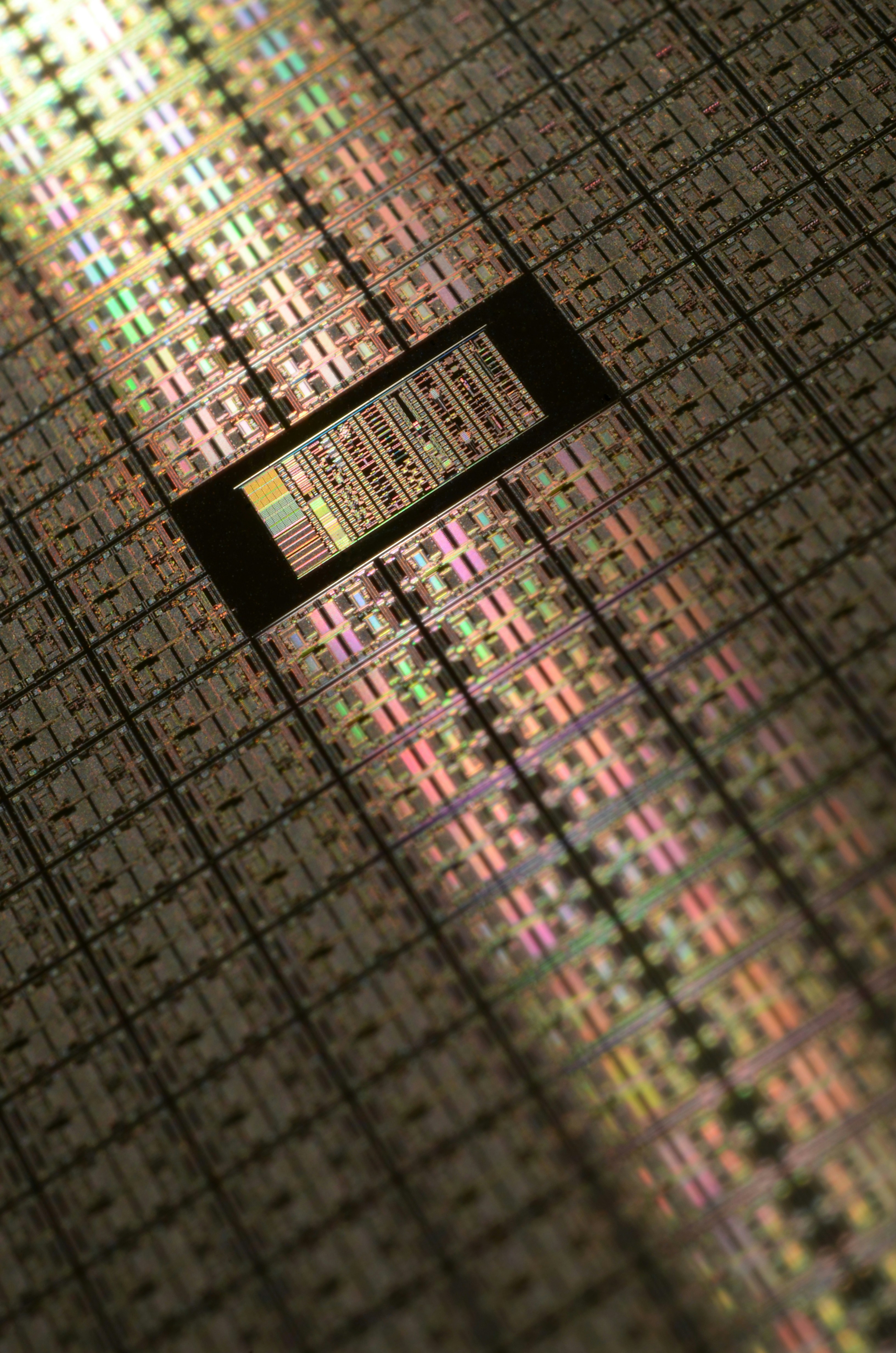

Recent developments, such as Intel’s initiatives in developing 7nm chips and expanding foundry services, reflect its intent to reclaim leadership within the semiconductor landscape. As the company navigates these dynamics, observing Intel’s strategic maneuvers offers essential insights into the factors likely to influence its stock performance heading into 2025. Understanding Intel’s current market position provides a vital context for analyzing future stock price predictions.

Key Factors Influencing Intel’s Stock Price

Several key factors are poised to shape Intel’s stock price leading into 2025, reflecting a complex interplay between technological, economic, and competitive elements. At the core of this discussion are technological advancements that are driving the semiconductor industry forward. As Intel invests in research and development, innovations in processing power, energy efficiency, and chip architecture will play a critical role in determining market interest and, by extension, stock performance. Advancements in artificial intelligence, machine learning, and 5G technology are likely to enhance demand for semiconductors, thereby positively impacting Intel’s valuation.

Another crucial factor is the forecasting of demand for semiconductors. With the increasing reliance on technology in various sectors—including automotive, telecommunications, and consumer electronics—Intel’s ability to predict and respond to this demand will significantly influence its stock price. Factors such as the growth of Internet of Things (IoT) devices and smart technology adoption create an environment ripe for investment and growth if managed effectively.

Supply chain considerations also warrant attention in the analysis of Intel’s stock trajectory. The global semiconductor shortage, underscored by geopolitical tensions and manufacturing disruptions, has highlighted the vulnerabilities in supply chains. Intel’s capacity to navigate these challenges will be vital in maintaining production levels and meeting market expectations.

Furthermore, shifts in consumer behavior, influenced by trends such as remote work and streaming services, can alter the demand landscape for Intel products. Understanding consumer preferences will guide Intel in aligning its offerings with market needs. Additionally, competition dynamics—particularly from other semiconductor companies—will inevitably affect Intel’s market share and pricing strategies. Finally, macroeconomic factors such as inflation rates and interest rate fluctuations can impact consumer spending and investment, all of which play a role in shaping Intel’s stock performance as we approach 2025.

Analyst Predictions and Market Sentiment

Financial analysts have been closely monitoring Intel Corporation as it navigates through a rapidly evolving semiconductor landscape. As we look towards 2025, various predictions regarding Intel’s stock performance have emerged, reflecting diverse insights shaped by market trends and company developments. Analysts’ ratings predominantly range from ‘hold’ to ‘buy,’ with a notable consensus on the company’s potential for gradual recovery driven by strategic investments in new technologies.

Target price forecasts for Intel stock have varied significantly, with estimates spanning from $40 to $65 per share. This disparity highlights the uncertainty surrounding factors such as competition, innovation, and market demand. For example, some analysts emphasize the importance of Intel’s upcoming product launches and advancements in manufacturing processes, predicting that successful execution could catalyze substantial price increases. In contrast, others express caution, voicing concerns over the competitive pressures exerted by rivals like AMD and Nvidia.

Market sentiment around Intel remains equally polarized, incorporating both bullish and bearish viewpoints. Bullish analysts point to the firm’s potential to regain market share in key sectors such as artificial intelligence and data centers, while bearish perspectives emphasize the risks of supply chain disruptions and the ongoing semiconductor shortage. Recent investment trends suggest heightened interest in Intel, with many institutional investors gradually accumulating shares. This strategic move reflects a belief among some that the stock is undervalued, especially as the company adapts to the changing technological landscape.

In summary, while the outlook for Intel’s stock price in 2025 is influenced by a myriad of factors including product launches, competitive positioning, and overall market dynamics, it remains imperative for investors to consider diverse analyst insights and evolving market sentiment when making investment decisions.

Strategies for Investors: What to Watch in 2025

As investors consider incorporating Intel into their portfolios, the year 2025 promises to be a pivotal period, characterized by fluctuating market dynamics and emerging technological advancements. To navigate this landscape effectively, investors should focus on several key indicators. First and foremost, monitoring quarterly earnings reports is crucial. These reports not only provide insight into Intel’s financial health but also reveal trends in revenue growth, profit margins, and expenses, which can inform investment decisions.

Product launches also warrant attention, as they can significantly impact Intel’s market position and stock performance. The company’s ability to innovate and release competitive products is critical in a rapidly evolving technology sector. Investors should keep track of announcements related to new processors, advancements in semiconductor technology, and collaborations with major tech firms. Understanding the implications of these developments will aid investors in making informed choices regarding their Intel stock holdings.

Market trends serve as another important consideration. The tech industry is influenced by various external factors, such as shifts in consumer demand, regulatory changes, and global supply chain disruptions. By staying abreast of these trends, investors can better anticipate Intel’s future performance and adjust their strategies accordingly. Additionally, diversification is vital when investing in technology stocks like Intel. By spreading investments across different sectors, investors can mitigate risks associated with market volatility.

Risk management strategies should also be an integral part of any investment plan. Investors must evaluate their risk tolerance and consider potential scenarios—optimistic, pessimistic, and neutral—regarding Intel’s future performance. An optimistic outlook may rely on strong product launches and favorable market conditions, while a pessimistic view could stem from increased competition or economic downturns. Therefore, having a flexible strategy that accommodates varying market scenarios is essential for making sound investment decisions in the tech sector.