What is a Stock Split?

A stock split is a corporate action that involves dividing existing shares of a company into multiple new shares. This process increases the total number of shares outstanding while proportionally decreasing the share price, leaving the overall value of the company unchanged. A stock split is primarily executed to make shares more affordable to a broader range of investors, potentially enhancing liquidity. The company’s market capitalization remains the same post-split, as the total equity attributed to all its shares remains unchanged.

There are two primary forms of stock splits: forward splits and reverse splits. A forward split increases the number of shares and reduces the share price. For instance, in a 2-for-1 forward split, each shareholder receives an additional share for every share they currently own. This means that if pre-split, an individual held 100 shares valued at $100 each, after the split, they would own 200 shares valued at $50 each. The total investment value remains at $10,000.

Conversely, a reverse split consolidates shares, reducing the total number while increasing the share price. This is commonly undertaken by companies wishing to elevate their stock price to meet listing requirements on exchanges or to improve their market perception. For instance, a 1-for-10 reverse split would convert ten existing shares into one share, thereby increasing the price per share tenfold. Although the number of shares held decreases, the inherent value of the investment remains unchanged.

In essence, the rationale behind implementing a stock split, either forward or reverse, revolves around market perception and the psychological motivation of investors. A lower share price via a forward split can attract retail investors, while a reverse split can present a more prestigious image for a company. Understanding these mechanics sets the foundation for analyzing the implications of stock splits, including Broadcom’s recent decision to split its stock.

Overview of Broadcom’s Stock Split Announcement

In a significant move aimed at enhancing shareholder value and boosting market presence, Broadcom Inc. recently announced a stock split. This decision, revealed on October 15, 2023, underscores the company’s commitment to maintaining a flexible and accessible capital structure that aligns with common industry practices. The split is structured at a ratio of 4-for-1, meaning that for every share currently held by investors, they will receive four shares post-split.

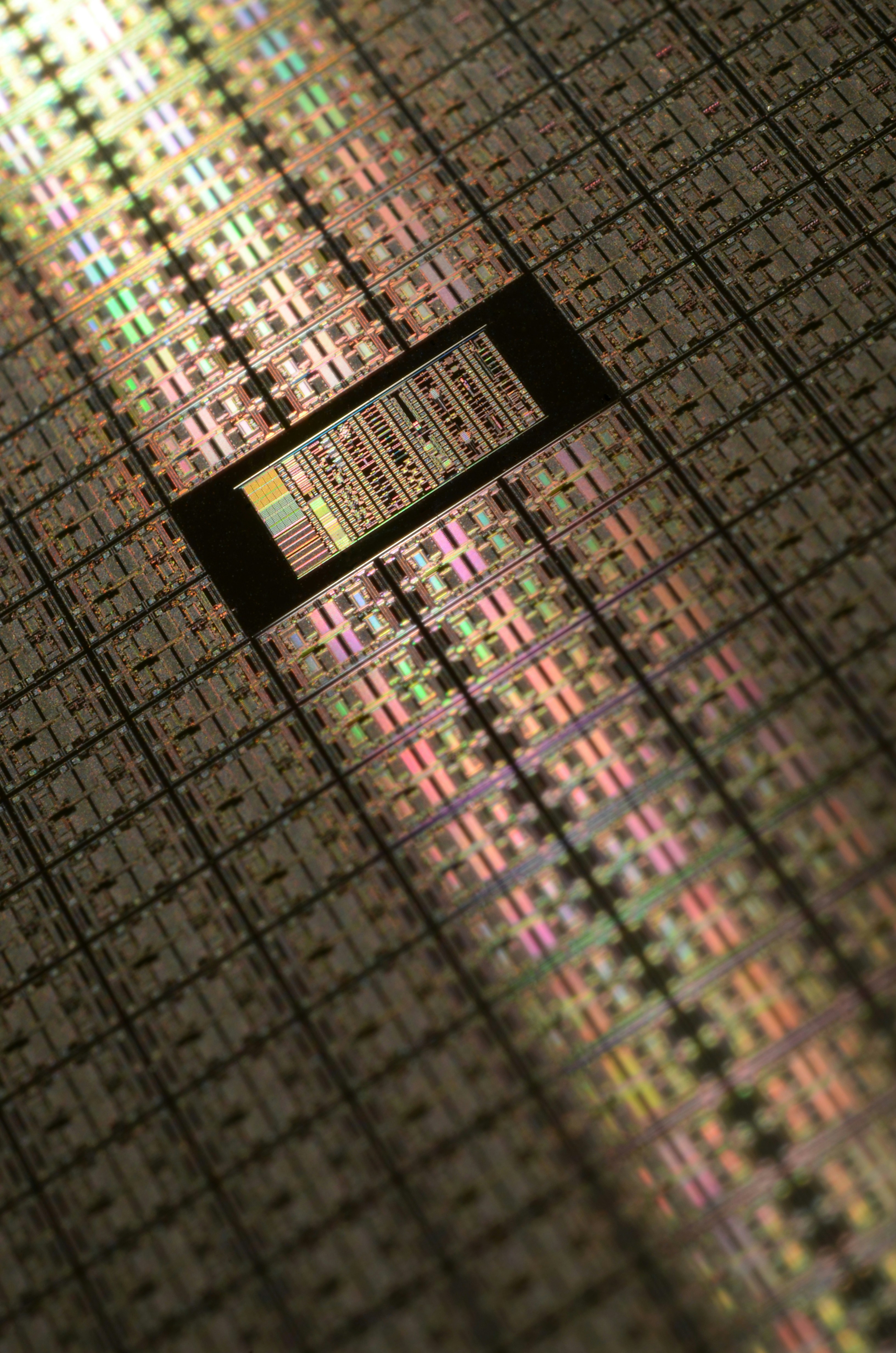

The announcement comes at a time when Broadcom is experiencing robust performance, driven by the growing demand for semiconductor solutions in various sectors including telecommunications and cloud computing. By executing this stock split, Broadcom aims to improve liquidity within its stock, thereby enabling a broader array of investors to participate in the company’s ongoing growth trajectory. Additionally, a lower price per share can attract smaller investors who may have previously viewed the stock as prohibitively expensive.

Such capital restructuring initiatives are not uncommon within the technology sector, where companies strive to make their shares more accessible amid rising stock prices. By reducing the stock price through a split, Broadcom not only enhances its market appeal but also aligns itself with practices employed by several industry peers. This strategic move reflects an understanding of market dynamics and investor behaviors, illustrating Broadcom’s proactive approach in an evolving marketplace.

Management has indicated that the primary goal of this stock split is to broaden the base of common stock ownership, which could potentially lead to increased demand for shares. This decision resonates with the company’s long-term objectives and emphasizes its underlying confidence in future growth prospects, paving the way for long-term investment and engagement from various investor classes.

Market Reactions and Investor Sentiment

The announcement of Broadcom’s stock split marked a significant moment in the company’s history and elicited varied reactions from market participants. Stock splits are often perceived as a strategy to enhance liquidity and make shares more accessible to a wider range of investors. Following the announcement, Broadcom’s stock exhibited notable performance metrics that are critical for understanding the market’s response. Leading up to the split, the stock had demonstrated a consistent upward trend, signaling investor confidence and positive market conditions.

In the subsequent days after the split, trading volumes experienced considerable fluctuations. Increased trading activity was observed, indicating heightened interest from both institutional and retail investors. Typically, a stock split results in greater trading volumes as investors adjust their portfolios and new buyers enter the market. This pattern was evident with Broadcom, as the share price saw a brief surge immediately post-split, suggesting a favorable reception by the market. However, the stock also faced corrective movements shortly afterward, which is not uncommon as short-term volatility settles following such corporate actions.

Analyzing investor sentiment is crucial in this context. Media coverage surrounding the stock split focused on Broadcom’s long-term growth potential, its strategic positioning within the semiconductor industry, and general market conditions influencing tech stocks. Social media discussions echoed similar themes, with many investors expressing optimism about the company’s future prospects. However, there were contrasting opinions, as some investors raised concerns regarding potential overvaluation following the split. Therefore, while there was a substantial positive sentiment overall, skepticism persisted, particularly regarding market sustainability and economic conditions. This multifaceted reaction illustrates that investor sentiment towards Broadcom remains cautious yet optimistic, reflecting the complexities of assessing stock splits in fluctuating markets.

Future Implications for Broadcom and Investors

The announcement of Broadcom’s stock split could signify a pivotal moment for both the company and its investors. Stock splits often generate increased investor interest, providing an opportunity for greater accessibility among retail investors. By reducing the price per share, Broadcom may bolster its attractiveness to a broader audience, including younger or less financially-endowed investors who may perceive shares as more affordable. This phenomenon can lead to heightened trading volume and liquidity in the short run, potentially stimulating demand for the stock.

From a company standpoint, a stock split aligns with Broadcom’s long-term objective of maintaining competitive positioning within the technology sector. It enables the company to highlight its burgeoning growth trajectories and enhances institutional investor interest by fostering a larger shareholder base. Moreover, as Broadcom continues its strategy of innovation and market expansion, the split could help solidify its presence in the semiconductor landscape, positively impacting growth projections and profitability over time.

For existing and prospective investors, this stock split presents several strategic considerations. Investors might reassess their portfolio allocations in light of the increased accessibility and potential for price appreciation. Additional analysis is warranted to evaluate whether the current share price reflects the underlying business fundamentals post-split. Furthermore, engaging in a diversified investment approach is crucial, as the technology sector can experience volatility driven by various market forces including economic cycles and technological advancements.

In this evolving landscape, investors should remain vigilant, adjusting their strategies to capitalize on Broadcom’s growth potential while also considering their risk tolerance and investment horizons. The stock split indeed creates favorable conditions but demands careful analysis to ensure that investment decisions align with both immediate and long-term financial goals.