Overview of the Share Sale

Recently, Nvidia’s Executive Vice President, Jeff Shoquist, executed a notable transaction involving the sale of $41.4 million in shares. This strategic move has sparked interest among stakeholders and market analysts alike, prompting a deeper examination of the implications surrounding such a decision. The sale comprised approximately 100,000 shares, a significant portion of his holdings, which indicates a calculated approach to portfolio management amidst fluctuating market conditions.

The timing of this sale is particularly worth noting, given the broader context of Nvidia’s performance in the technology sector, especially in areas like graphics processing and artificial intelligence. As Nvidia has experienced substantial growth and an increase in stock value over recent quarters, such a substantial liquidation could suggest a pivotal moment in Shoquist’s investment strategy. It raises questions about whether this action was motivated by a need for liquidity for personal reasons or an indicator of potential stock price volatility.

Historically, Jeff Shoquist has engaged in varied sales and purchases related to Nvidia shares, which adds a layer of insight into his overall investment patterns. Previous transactions show a consistent pattern of adjusting his portfolio in alignment with the company’s performance and market trends. This recent share sale could reflect a strategy focused on diversifying his investments while still demonstrating confidence in Nvidia’s long-term potential. Nevertheless, it is essential to highlight that executive share sales, while sometimes interpreted negatively, can also be part of a broader financial planning approach.

As analysts continue to dissect the motivations behind such stock transactions, it will be interesting to observe the potential ramifications on Nvidia’s stock price and investor confidence in the technology giant. The broader implications of Shoquist’s actions warrant careful consideration, particularly in light of the company’s standing in the competitive landscape.

Market Reactions and Stock Performance

The recent sale of $41.4 million in Nvidia shares by Executive Vice President Debora Shoquist has garnered significant attention within the financial community, prompting immediate reactions in the stock market. Following the announcement of the share sale, Nvidia’s stock price experienced notable fluctuations. Initial trading sessions witnessed a decline in the share price, which can often be attributed to investor apprehension regarding insider trading activities. Market participants frequently interpret such transactions as a signal that company insiders may lack confidence in the firm’s future performance.

In the days following Shoquist’s sale, Nvidia’s stock exhibited a combination of volatility and resilience. While the stock initially dipped by approximately 4%, it gradually recovered, reflecting a broader trend of volatility observed across the tech sector. This recovery could be indicative of a robust underlying demand for Nvidia shares, fueled by optimism surrounding the company’s strategic direction and strong market fundamentals. Analysts observed that the fluctuations may also reflect market reactions to the wider economic environment, characterized by interest rate adjustments and inflationary concerns that impact investor sentiment.

Market analysts express varying opinions regarding the implications of Shoquist’s sale on investor perception. Some believe that insider sell-offs can sometimes lead to a temporary decline in stock performance, as they may incite fear or uncertainty among investors. Conversely, others argue that such transactions are commonplace and do not necessarily reflect broader weaknesses within the organization. As Nvidia continues to innovate within the semiconductor industry, the resilience of its stock price, even amidst insider trading activities, suggests that investor confidence remains largely intact. An analysis of analyst ratings reveals a generally positive outlook, indicating that market sentiment may prioritize Nvidia’s long-term prospects over immediate trading maneuvers by insiders. In conclusion, while insider transactions like Shoquist’s can impact share prices in the short term, they do not appear to alter the fundamental strength of Nvidia as a market leader.

Understanding Insider Trading: Legal and Ethical Aspects

Insider trading refers to the buying or selling of publicly-traded securities based on non-public material information about the company. The legal framework governing insider trading varies across jurisdictions; however, in the United States, it is primarily regulated by the Securities and Exchange Commission (SEC). The SEC enforces strict rules to prevent insiders, such as executives or employees, from exploiting confidential information for financial gain. When executives like Nvidia’s EVP, Debora Shoquist, sell shares, it is often scrutinized under these regulations to ensure compliance.

Executives are legally required to disclose their transactions in company stock within a certain period, typically through filings such as Form 4. This disclosure aims to maintain market integrity and provide transparency to investors. While selling shares may be legal, it opens the door to ethical discussions surrounding shareholder trust. Shareholders rely on transparency from executives to guide their investment decisions, and any suspicion of impropriety can damage that trust. For instance, if shareholders believe that an executive’s decision to sell is based on insider knowledge about impending negative news, it could lead to reputational harm and a decline in stock prices.

Cases within the tech industry have highlighted these ethical dilemmas. For example, when executives from major companies have engaged in share sales shortly before adverse announcements, this has raised questions about their motivations. Such actions can suggest a lack of confidence in the company’s future, impacting shareholder sentiment. Therefore, while legally permissible, insider trading practices must be approached with ethical considerations in mind to uphold the trust and assurance of all stakeholders involved.

Ultimately, understanding both the legal and ethical aspects of insider trading is essential. Such knowledge helps foster an environment of accountability and transparency, which is crucial for maintaining the integrity of financial markets.

Looking Ahead: Impact on Nvidia’s Future and Investor Considerations

The recent sale of $41.4 million in Nvidia shares by Executive Vice President Debora Shoquist raises pertinent questions regarding the company’s future trajectory and its implications for investors. Insider selling can often be interpreted in various ways; although it may signal a lack of confidence in the company’s immediate prospects, it could also reflect personal financial planning on the part of the executive. Understanding the context behind such transactions is critical for shareholders and potential investors.

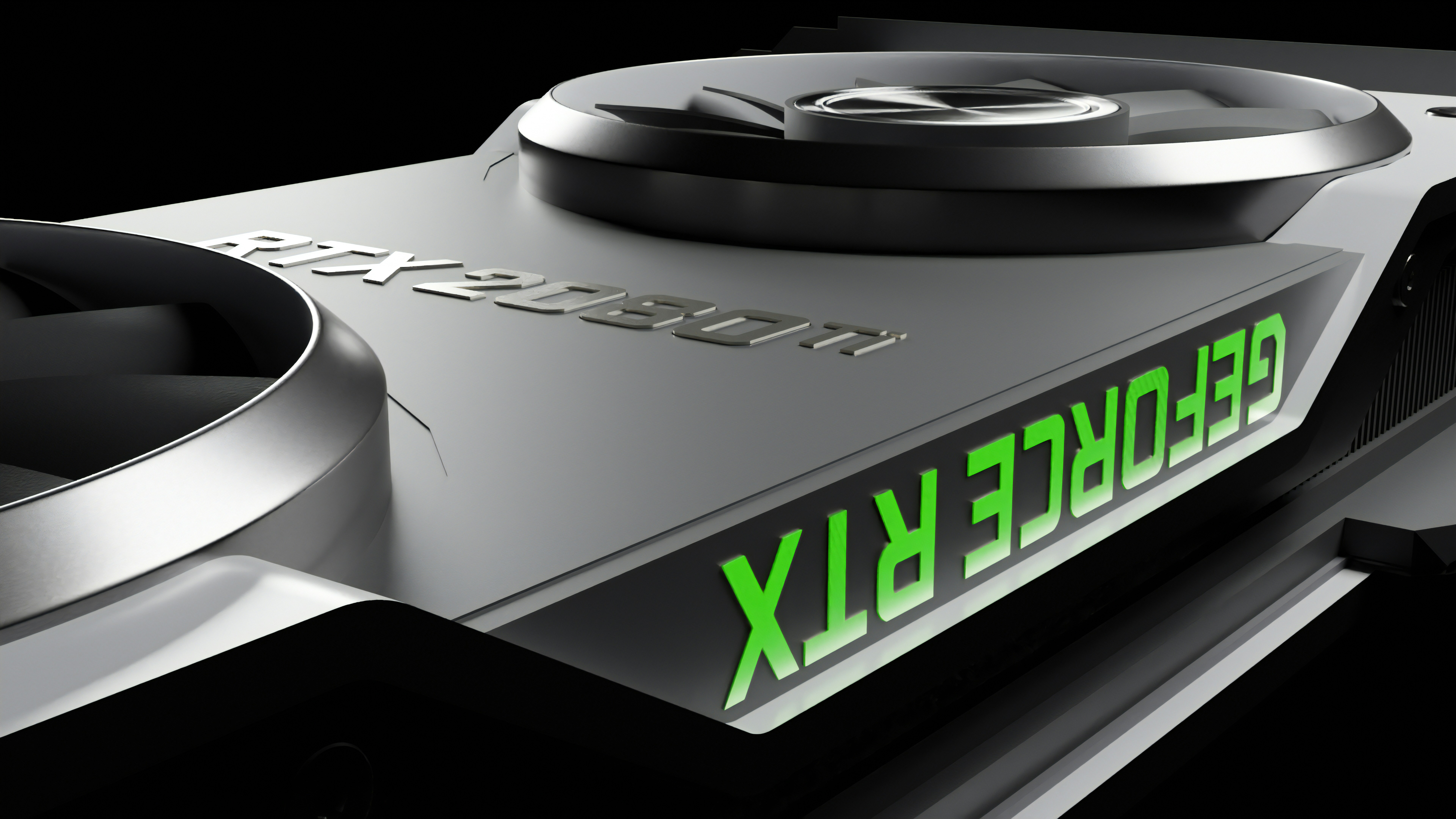

Nvidia, a leader in GPU technology, AI, and computing, stands at a crucial juncture. Its strategies moving forward, particularly in expanding its product offerings and maintaining its competitive edge in a rapidly evolving market, will be instrumental in sustaining investor confidence. The company’s success hinges on its ability to innovate and navigate challenges such as supply chain constraints and geopolitical tensions that may impact market dynamics.

For investors, it is essential to consider multiple factors before interpreting Shoquist’s share sale. Evaluating the company’s ongoing projects, technological advancements, and market positioning can provide insight into Nvidia’s future growth potential. Additionally, staying abreast of industry trends and competitor movements will aid in formulating informed investment decisions. Transparency in the company’s communications and financial performance is another vital element to monitor, as these aspects can significantly influence stock valuation.

Ultimately, while insider selling warrants scrutiny, it should not solely dictate investment strategies. Instead, a comprehensive analysis of Nvidia’s long-term prospects, strategic initiatives, and market conditions should guide investor behavior. By maintaining a balanced perspective and leveraging available information, stakeholders can make more informed decisions regarding their position in Nvidia.